Is Trump Against IVF? Unpacking the Facts, Policies, and What It Means for You

April 12, 2025

Can You Choose Gender with IVF?

April 12, 2025How to Get IVF Covered by Insurance: Your Ultimate Guide to Navigating the Process

In vitro fertilization (IVF) can feel like a lifeline for those dreaming of starting a family, but the price tag? It’s enough to make anyone pause. With costs often soaring past $20,000 per cycle, it’s no wonder so many people turn to their insurance for help. The good news is that getting IVF covered isn’t impossible—it just takes some know-how, persistence, and a little creativity. Whether you’re just starting to explore fertility options or you’ve already hit a few roadblocks, this guide is here to walk you through every step of the process. From decoding your insurance policy to tapping into lesser-known resources, we’ve got you covered with practical tips, fresh insights, and a few surprises along the way.

Understanding IVF and Insurance: The Basics You Need to Know

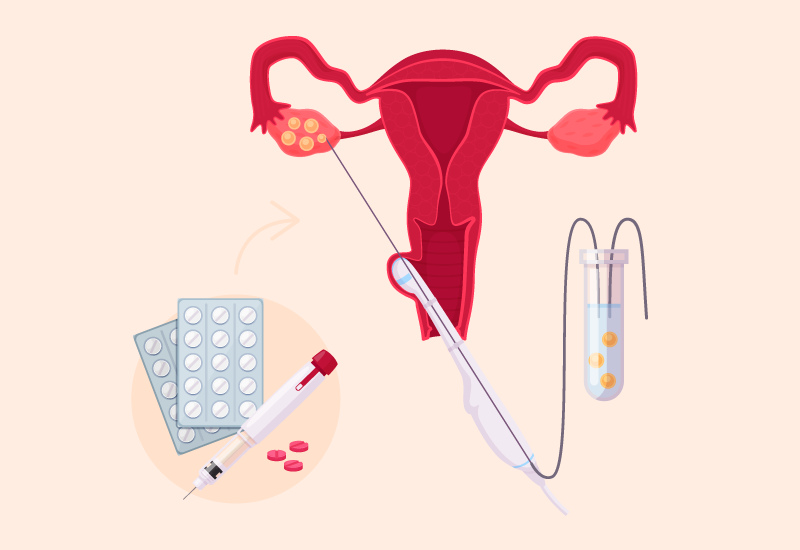

IVF is a process where eggs are retrieved from the ovaries, fertilized with sperm in a lab, and then placed back into the uterus to (hopefully) grow into a healthy pregnancy. It’s a game-changer for many, but it’s also expensive—think $12,000 to $15,000 for the procedure alone, plus another $3,000 to $7,000 for medications. That’s where insurance comes in. Some plans cover IVF fully, others partially, and many don’t cover it at all. So, how do you figure out where you stand?

First off, not all insurance is created equal. Coverage depends on your plan, your employer, and even where you live. As of April 2025, 21 states in the U.S. have laws requiring some level of fertility treatment coverage, but only 15 mandate IVF specifically. States like California, New York, and Illinois are leading the charge, while others lag behind. If you’re in a state without a mandate, don’t lose hope—there are still ways to make it work.

The trick is knowing what to look for. Your insurance policy might cover diagnostic tests (like bloodwork or ultrasounds) even if it skips the big-ticket items like egg retrieval. And here’s a fun fact: a 2022 study from the American Society for Reproductive Medicine found that fewer than 25% of infertile couples have adequate access to care, often because of insurance gaps. That’s why understanding your starting point is key—it’s the foundation for everything else.

Quick Checklist: Does Your Insurance Cover IVF?

- ✔️ Check if you live in a state with an IVF mandate (e.g., California, New York, Massachusetts).

- ✔️ Look at your plan type—large employer plans (100+ employees) are more likely to offer coverage.

- ❌ Don’t assume “infertility treatment” includes IVF—some plans stop at basic stuff like medication.

- ✔️ Call your insurer to confirm details—policies can be sneaky!

Step 1: Decode Your Insurance Policy Like a Pro

Your insurance policy is basically a treasure map—if you can read it right, you might find gold. Start by grabbing your plan documents. Look for sections labeled “infertility,” “fertility treatments,” or “reproductive health.” IVF might be listed explicitly, or it could be lumped under something vague like “assisted reproductive technology” (ART). Either way, you’re hunting for specifics: Does it cover egg retrieval? Embryo transfer? Medications?

Here’s a real-world tip: don’t just skim the fine print—search for exclusions too. Some plans say “no IVF” outright, while others have sneaky rules, like requiring you to try other treatments (like intrauterine insemination, or IUI) for six months first. A 2023 survey by Fertility IQ found that 74% of insurance plans offering IVF coverage had at least one prerequisite, like seeing a specialist or proving infertility for a year.

If the jargon feels overwhelming, focus on these key terms:

- Deductible: How much you pay before coverage kicks in.

- Co-pay: A flat fee per visit or service.

- Co-insurance: A percentage of the cost you split with the insurer.

- Out-of-pocket maximum: The most you’ll pay in a year—hit this, and IVF might be “free” after.

Action Step: Call Your Insurer

Pick up the phone and ask:

- “Does my plan cover IVF, and if so, what parts?”

- “Are there any pre-approvals or waiting periods?”

- “What’s my out-of-pocket max, and how close am I to hitting it?”

Write down who you spoke to and what they said—trust me, it’ll save you headaches later.

Step 2: Leverage State Laws to Your Advantage

Where you live can make or break your IVF coverage. State mandates are like secret weapons—if you’re in the right spot, they can force your insurer to pay up. As of early 2025, California’s new law (SB 729) requires large group plans to cover up to three egg retrievals and unlimited embryo transfers starting July 1. New York’s mandate is even broader, covering IVF for most private plans. But if you’re in a state like Florida or Texas? You’re mostly on your own unless your employer opts in.

Here’s the catch: mandates usually apply to “fully insured” plans (where your employer buys insurance from a company like Blue Cross). If your job “self-insures” (they pay claims directly), federal law lets them dodge state rules. About 60% of U.S. workers are in self-insured plans, per a 2024 Kaiser Family Foundation report, so this matters.

Pro Tip: Move the Needle

If you’re in a non-mandate state, check your employer’s size. Companies with 100+ employees are more likely to offer fertility benefits—think 45% versus 25% for smaller firms, according to a 2023 Mercer study. Can’t move states? You might still qualify for coverage if your employer’s headquarters is in a mandate state, even if you’re remote.

Step 3: Talk to Your Employer (Yes, Really!)

Your boss might hold the key to IVF coverage without even knowing it. More companies are jumping on the fertility benefits bandwagon—think Google, Amazon, and even smaller startups. A 2024 report from Carrot Fertility says 68% of large U.S. employers now offer some fertility support, up from 56% in 2020. Why? It’s a perk that keeps workers happy and loyal.

Start by asking HR: “Do we have any fertility benefits?” If the answer’s no, don’t stop there. Share a quick stat: covering IVF can boost employee retention by 20%, per a 2023 SHRM study. Suggest they look into “add-on” plans from insurers or third-party providers like Progyny or Carrot. These programs often bundle IVF with other perks (like egg freezing) for a flat fee.

Real-Life Win: Sarah’s Story

Sarah, a 32-year-old teacher in Ohio, found out her school district didn’t cover IVF. She pitched the idea to HR, armed with data about happier employees and lower turnover. Six months later, they added a $10,000 IVF benefit. It wasn’t full coverage, but it slashed her costs in half. Moral? A little nudge can go a long way.

Step 4: Maximize What’s Already Covered

Even if IVF isn’t on the table, your insurance might still chip in. Diagnostic tests—like hormone checks or semen analysis—often fall under general medical coverage. Medications like Clomid or gonadotropins might be covered under your pharmacy plan, too. A 2022 NPR report found that patients with partial coverage still faced surprise bills, but starting with what’s covered can save thousands.

Here’s a sneaky move: time your IVF cycle to hit your out-of-pocket maximum early in the year. Say your max is $5,000, and you’ve already spent $2,000 on other care. A $15,000 IVF cycle could cost you just $3,000 out of pocket if you play it right. Check your claims history online to see where you stand.

Mini Quiz: What’s Covered?

Answer yes or no to see how much you can squeeze from your plan:

- Does your policy cover blood tests for infertility? (Hint: Most do!)

- Are fertility drugs like Clomid on your formulary? (Check your drug list.)

- Can you use an in-network specialist? (Out-of-network costs more.)

Score three “yeses”? You’re off to a solid start.

Step 5: Explore Creative Workarounds

No coverage? No problem—well, not entirely. There are ways to make IVF happen without breaking the bank. First, look into fertility clinics with sliding-scale fees. Some, like CNY Fertility, offer IVF for as low as $4,900 per cycle—way below the national average. Pair that with a payment plan, and it’s suddenly doable.

Another option: clinical trials. The National Institutes of Health lists studies offering free or discounted IVF if you qualify (check clinicaltrials.gov). A 2024 trial in Boston, for example, covered IVF for women testing a new embryo-screening tech. Risks? Sure, but the savings can be massive.

Hidden Gem: HSAs and FSAs

Got a Health Savings Account (HSA) or Flexible Spending Account (FSA)? You can use pre-tax dollars for IVF, cutting your real cost by 20-30%. In 2025, HSA limits are $4,150 for individuals and $8,300 for families—plenty to cover meds or part of a cycle. Ask your employer how to max it out.

Step 6: Appeal Denials Like a Champ

If your insurer says “no” to IVF, don’t take it lying down. Appeals work more often than you’d think—a 2023 Resolve study found 1 in 3 denials get overturned with a solid case. Start by requesting the denial in writing, then build your argument:

- Medical necessity: Get a doctor’s note saying IVF is your best shot.

- Policy gaps: Point out if their denial contradicts your plan’s language.

- State law: Cite your mandate if you’re in a covered state.

File your appeal within 60 days (check your policy for the exact deadline). A friend of mine, Lisa, won her appeal in New Jersey by showing her plan’s “infertility treatment” clause should include IVF. It took two months, but she saved $12,000.

Appeal Cheat Sheet

- Gather proof: Doctor letters, test results, policy pages.

- Write a clear letter: “I’m appealing the denial of IVF coverage on [date] because…”

- Submit and follow up: Call weekly to keep the pressure on.

The Emotional Side: Coping with the Cost Struggle

Let’s be real—chasing IVF coverage can feel like a full-time job. The back-and-forth with insurers, the endless paperwork, the “no”s—it’s exhausting. A 2024 study in Fertility and Sterility found that financial stress doubles anxiety levels in IVF patients. So, give yourself grace. Lean on support groups (Resolve.org has free ones) or a friend who gets it. You’re not alone in this.

Quick Poll: How Do You De-Stress?

Pick your go-to and share in the comments:

- A) Binge-watch a silly show

- B) Vent to a buddy

- C) Take a long walk

- D) Other (spill the tea!)

Fresh Angles: What Others Miss

Most articles stop at “check your policy” or “move to a mandate state,” but there’s more to the story. Here are three angles you won’t find everywhere:

1. The Telehealth Boom

Since 2020, telehealth fertility clinics have exploded—think Kindbody or Future Family. They often partner with insurers to offer virtual consults and discounted IVF packages. A 2025 X post from @FertilityNow highlighted a woman saving 15% by going virtual. Bonus: no travel costs.

2. Employer Negotiation Power

Beyond asking HR, pitch IVF as a diversity win. Same-sex couples and single folks often need IVF to build families, and inclusive benefits signal a modern workplace. A 2024 LinkedIn survey showed 72% of Gen Z workers value fertility perks—your company might listen.

3. Micro-IVF: The Budget Option

Ever heard of mini-IVF? It uses lower doses of meds (cutting costs to $5,000-$7,000 per cycle) and works for younger patients or those with mild issues. A 2023 study in Human Reproduction found success rates near 40% for women under 35—not far off full IVF’s 50%. Ask your doc if it’s a fit.

Crunching the Numbers: A Simple Cost Breakdown

I did some back-of-the-napkin math based on 2025 averages. Here’s what one IVF cycle might look like with and without insurance:

| Expense | No Coverage | Partial Coverage (50%) | Full Coverage |

|---|---|---|---|

| Procedure ($12,000) | $12,000 | $6,000 | $0 |

| Meds ($5,000) | $5,000 | $2,500 | $0 |

| Tests ($1,000) | $1,000 | $500 | $0 |

| Total | $18,000 | $9,000 | $0 |

Now, factor in an HSA with $4,000: your “no coverage” cost drops to $14,000. Hit your $5,000 out-of-pocket max? Partial coverage could shrink to $5,000. Small tweaks, big savings.

Your Next Move: Putting It All Together

So, where do you start? Grab a coffee, a notebook, and your insurance card. Step one: call your insurer and map out your coverage. Step two: check your state’s laws and your employer’s perks. Step three: explore workarounds like mini-IVF or trials. And if you hit a wall, appeal or negotiate—don’t give up.

IVF is a marathon, not a sprint. But with the right strategy, you can cross that finish line without draining your savings. You’ve got this—and if you need a pep talk, I’m just a comment away. What’s your first step going to be?