How Many Follicles Do You Need for IVF Success?

April 23, 2025

How Much Is IVF in Florida? Your Complete Guide to Costs, Options, and Insights

April 23, 2025How Much Does IVF Cost with Insurance?

In vitro fertilization (IVF) is a life-changing option for many people dreaming of starting a family. But let’s be real—when you start digging into the costs, it can feel overwhelming. If you’re wondering how much IVF costs with insurance, you’re not alone. It’s a big question, and the answer isn’t always straightforward. Insurance can make a huge difference, but it depends on so many factors: where you live, your plan, and even your employer. In this deep dive, we’ll break it all down so you can get a clear picture of what to expect—and how to make it work for you.

What’s the Real Price Tag of IVF?

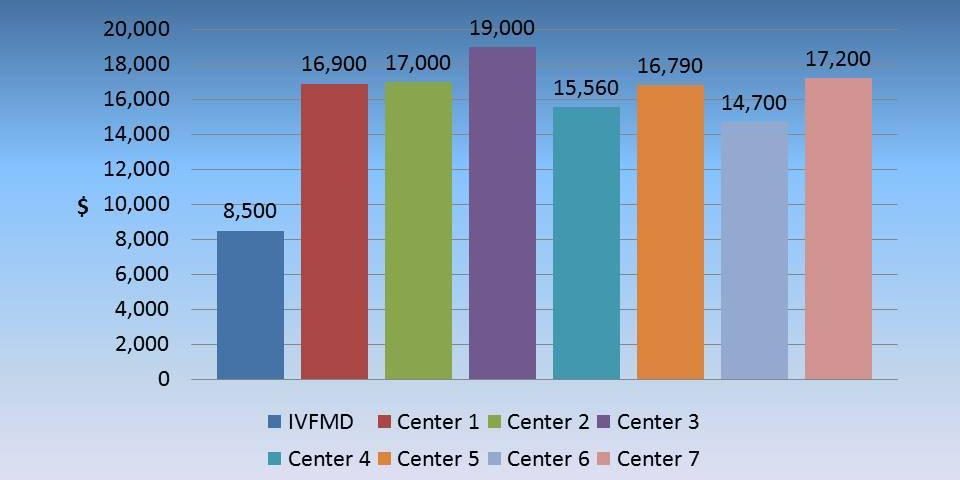

IVF isn’t cheap. Without insurance, a single cycle can set you back anywhere from $15,000 to $30,000 in the U.S. That’s a wide range because it depends on things like your clinic, the medications you need, and any extra procedures (think genetic testing or donor eggs). Add in the fact that many people need more than one cycle—sometimes two or three—and the numbers climb fast. The average person might spend $50,000 or more before they hold a baby in their arms.

But here’s where insurance comes in. If you’ve got coverage, it can slash that bill significantly. Some plans cover the whole process, while others only chip in for parts like medications or testing. The catch? Only about 25% of Americans have IVF coverage through their insurance, according to the American Society for Reproductive Medicine. So, your first step is figuring out if you’re one of the lucky ones.

Breaking Down the Costs

To get a handle on this, let’s split IVF into its main pieces:

- Base Procedure: This includes egg retrieval, fertilization in a lab, and embryo transfer. It’s usually $10,000 to $15,000 per cycle without insurance.

- Medications: Fertility drugs to boost egg production can cost $3,000 to $7,000 per cycle. These vary based on your body’s needs.

- Extras: Things like genetic testing ($1,000-$5,000), embryo freezing ($1,000-$2,000 for storage), or using donor eggs ($20,000-$45,000) can pile on.

- Hospital Fees: If complications arise, you might face additional charges.

With insurance, some or all of these could be covered. But even with a good plan, you might still pay out-of-pocket for copays, deductibles, or uncovered services.

Does Your Insurance Cover IVF?

Not all insurance is created equal. Whether your plan covers IVF depends on a few big factors: your state, your employer, and the fine print of your policy. Let’s unpack this.

State Laws Make a Difference

In 2025, 21 states have laws requiring some level of fertility coverage, according to Resolve: The National Infertility Association. These are called “mandates,” and they force insurance companies to offer or fully cover treatments like IVF. States like California, New York, and Illinois are leading the charge. For example, California’s new law (signed in 2024) mandates coverage for large group plans starting July 2025, covering about 9 million people. That’s huge!

But there’s a twist: these mandates don’t apply to everyone. If your employer “self-insures” (meaning they pay claims directly instead of using an insurance company), they’re exempt. That’s about 61% of workers with employer-sponsored plans, per the Kaiser Family Foundation. So, even in a mandate state, you might still be on your own.

Employer Plans Vary Wildly

More companies are jumping on the fertility bandwagon, especially big ones like Google or Starbucks. They offer IVF benefits to attract talent in a tight job market. Some cover unlimited cycles, others cap it at $20,000 or three rounds. Smaller companies? Less likely. If you work for a business with under 50 employees, don’t hold your breath—many skip fertility benefits to keep costs down.

Public Insurance: Slim Pickings

If you’re on Medicaid, coverage is spotty. Most states don’t cover IVF at all, though some (like New York) offer limited help for diagnostics. Medicare? Forget it—fertility treatments aren’t on the table. For lower-income folks, this gap can feel like a brick wall.

Quick Quiz: Does Your Plan Cover IVF?

Take a sec to think about your situation:

- ✔️ Do you live in a state with an IVF mandate? (Check Resolve’s list!)

- ✔️ Is your employer self-insured, or do they use a standard insurance plan?

- ✔️ Does your job offer fertility benefits as a perk?

- ❌ If you’re on Medicaid or Medicare, assume IVF isn’t covered unless you’ve heard otherwise.

If you’re unsure, grab your insurance card and call the number on the back. Ask: “Does my plan cover in vitro fertilization?” It’s the fastest way to know.

How Much Can Insurance Save You?

Let’s say you’ve got coverage—awesome! But how much will it really help? It depends on your plan’s details. Here’s a rundown of what you might see:

Full Coverage Plans

In states like Massachusetts or New Jersey, some plans cover IVF end-to-end: doctor visits, meds, lab work, everything. Out-of-pocket costs might be as low as $500-$2,000 per cycle, mostly for copays or deductibles. A 2022 study in Fertility and Sterility found that people in mandate states use IVF 50% more than those without coverage—proof it makes a difference.

Partial Coverage Plans

More common are plans that cover pieces of the puzzle. Maybe they pay for medications (saving you $3,000-$7,000) but not the procedure itself. Or they cover diagnostics (like blood tests) but stop there. You could still be looking at $10,000+ out-of-pocket per cycle.

Real-Life Example

Meet Sarah, a 32-year-old teacher in Connecticut (a mandate state). Her insurance covers three IVF cycles, but she pays a $5,000 deductible first. Her meds are 80% covered, so she shells out $1,000 instead of $5,000. Total cost per cycle? About $6,000 instead of $20,000. Not cheap, but way more doable.

Hidden Costs Insurance Might Miss

Even with coverage, IVF can throw curveballs. Here are three expenses that often sneak up—and why they matter.

1. Pre-Treatment Testing

Before IVF, you’ll need tests like hormone checks or ultrasounds. These can cost $500-$2,000. Some plans cover them, but if yours doesn’t, it’s an early hit to your wallet. Tip: Ask your doctor to code these as “diagnostic” rather than “fertility”—it might trick insurance into paying.

2. Travel and Time Off

Clinics aren’t always nearby. If you’re driving hours for appointments or flying to a top facility, those costs add up—think gas, hotels, or plane tickets. Plus, IVF means missing work for monitoring and procedures. A 2024 survey by Carrot Fertility found 40% of patients spent over $1,000 on travel alone.

3. Emotional Support

IVF is a rollercoaster. Therapy or support groups can help, but they’re rarely covered. Sessions run $100-$200 a pop, and over months, that’s real money. Studies show 1 in 3 IVF patients experience anxiety or depression—don’t skimp here if you need it.

How to Maximize Your Insurance Benefits

You’ve got coverage—now what? Here’s how to squeeze every penny out of it.

Step-by-Step Guide

- Read Your Policy: Dig into the details. Look for terms like “infertility treatment” or “assisted reproductive technology.” Highlight limits (e.g., “two cycles max”).

- Call Your Insurer: Ask specific questions: “What’s my deductible? Are meds covered? Any in-network clinics?” Write down names and dates of who you talk to.

- Pick the Right Clinic: Use an in-network provider to avoid higher out-of-network rates. Your insurer can give you a list.

- Appeal Denials: If they say no, fight back. Submit a letter with your doctor’s support—stats show 20% of appeals win, per Resolve.

- Track Everything: Keep receipts, bills, and Explanation of Benefits (EOB) forms. It’s your ammo if something’s billed wrong.

Pro Tip: Timing Matters

Some plans run on a calendar year (January reset), others a plan year (check your start date). If you’re close to a reset, wait—your deductible might drop to zero, saving you thousands.

What If Insurance Doesn’t Cover IVF?

No coverage? Don’t panic—there are options. Here’s how people make it work.

Financing and Discounts

- IVF Loans: Companies like ARC Fertility offer loans with low interest. Monthly payments can drop costs to $300-$500.

- Clinic Discounts: Some offer “multi-cycle packages” (e.g., $25,000 for three tries) or mini-IVF (less meds, lower cost—around $5,000-$7,000).

- Grants: Groups like BabyQuest give $2,000-$15,000 to qualifying families. Apply early—funds run out fast.

Creative Savings

- Crowdfunding: Platforms like GoFundMe have helped thousands raise IVF cash. Share your story—people love to help.

- Tax Breaks: Medical expenses over 7.5% of your income are deductible. IVF often qualifies—talk to a tax pro.

- Side Gigs: A part-time job or selling stuff online can build a fund. One couple I know sold old furniture and made $1,500 toward their cycle.

Case Study: DIY Funding

Jake and Mia, a couple in Texas (no mandate), faced a $22,000 bill per cycle. Their insurance covered zilch. They took out a $10,000 loan, got a $5,000 grant, and saved $7,000 by cutting vacations and eating out. After two cycles, they welcomed twins—and say it was worth every penny.

Latest Trends: What’s Changing in 2025?

IVF costs and coverage are shifting. Here’s what’s hot right now—and how it affects you.

More States Jumping In

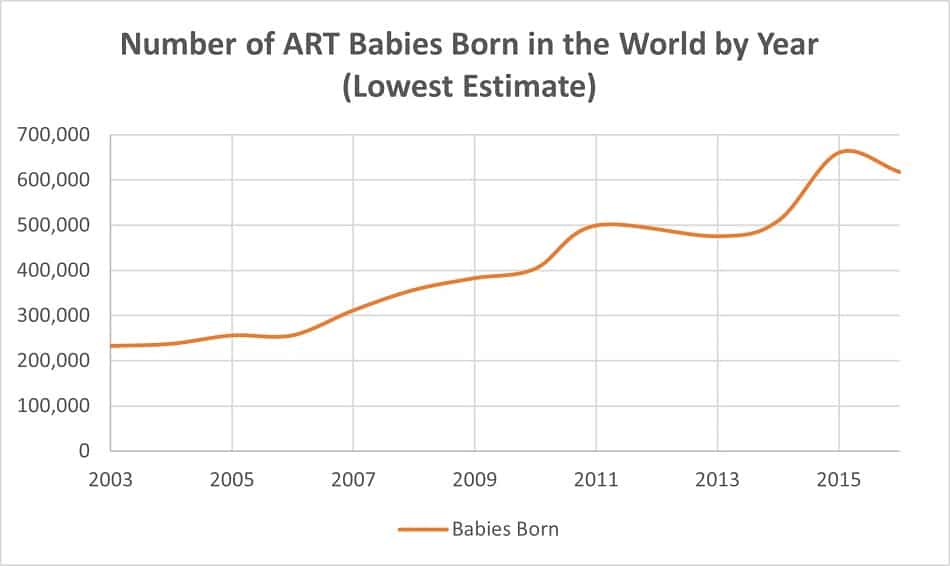

California’s 2024 law is a game-changer, and other states might follow. Posts on X in early 2025 show people buzzing about similar bills in Oregon and Michigan. Google Trends data from March 2025 shows “IVF insurance coverage” searches spiking 30% year-over-year—people want this.

Employers Stepping Up

A 2024 KFF report says 15% more employers added fertility benefits since 2020. Why? Workers demand it. If your company doesn’t offer it, ask HR—your voice could tip the scales.

Price Transparency Push

Clinics are under pressure to list prices upfront. A 2023 study in JAMA found 60% of fertility websites still hide costs. New federal rules might force clearer numbers by 2026, making it easier to shop around.

Three Big Questions You Haven’t Asked (But Should)

Most articles skip these—they’re gold for planning ahead.

1. How Does Coverage Affect Success Rates?

A 2022 study in Reproductive Biology and Endocrinology found mandate states have lower multiple births (twins, triplets) because coverage lets doctors transfer fewer embryos per cycle. Less risk, same reward. Without insurance, people push for more embryos, upping complications—and costs.

2. What’s the Long-Term Cost of No Coverage?

Say you skip IVF because it’s too pricey. A Stanford study from 2024 estimates infertile couples lose $50,000-$100,000 in lifetime earnings from stress and career delays. Add in mental health costs, and waiting might cost more than borrowing for IVF now.

3. Can Insurance Cover Future Fertility?

Freezing eggs or embryos now can save you later—especially if you’re under 35. Some plans cover this (e.g., Delaware’s mandate includes six retrievals). A 2025 Carrot Fertility survey found 25% of women wish they’d frozen earlier—insurance could’ve made it happen.

Poll: What’s Your Biggest IVF Worry?

Vote below—it takes 10 seconds and helps us tailor future tips!

- A) The cost, even with insurance

- B) Finding a good clinic

- C) Emotional stress

- D) Success rates

Practical Hacks to Cut Costs

You don’t need a fortune to make IVF work. Try these:

Shop Smart

- Compare clinic prices—some in smaller cities charge 20% less than urban hotspots.

- Ask about “shared risk” programs: Pay upfront, get a refund if it fails after X cycles.

Lean on Community

- Join online forums (Reddit’s r/infertility is gold). Members share discount codes and clinic recs.

- Swap meds with locals—unused fertility drugs often go to waste.

Mini-IVF: Worth It?

This uses fewer drugs, dropping costs to $5,000-$7,000. Success rates are lower (20-30% vs. 40-50% for standard IVF), but if you’re young with good egg quality, it’s a budget-friendly shot.

The Emotional Side: You’re Not Alone

Money’s only half the battle. IVF can feel isolating, but 1 in 8 couples face infertility, per the CDC. Talk to friends who’ve been there—or hit up a free support group (Resolve has tons). A 2024 study in Human Reproduction found people with strong support networks spent 15% less on therapy during IVF. Connection saves cash and sanity.

Wrapping It Up: Your Next Move

So, how much does IVF cost with insurance? It could be $500 or $15,000 per cycle—it’s all about your plan. Check your coverage, crunch the numbers, and don’t be afraid to get creative. Whether it’s haggling with your insurer, snagging a grant, or picking a cheaper clinic, you’ve got options. This journey’s tough, but with the right info, you can make it less of a financial maze.

Got a story about your IVF costs? Drop it in the comments—I’d love to hear how you’re navigating this!