How Much Does IVF Really Cost? Your Complete Guide to Understanding the Price Tag

April 11, 2025

What Is IVF Treatment?

April 11, 2025Does Insurance Cover IVF? Your Guide to Understanding Coverage, Costs, and Options

In vitro fertilization (IVF) is a life-changing option for many people dreaming of starting a family. But with costs that can climb into the tens of thousands of dollars, one big question looms large: Does insurance cover IVF? If you’re asking this, you’re not alone. Millions of Americans face infertility challenges, and figuring out the financial side can feel overwhelming. The good news? Coverage is evolving, and there are ways to make IVF more affordable, even if your insurance doesn’t fully step up.

This guide dives deep into the world of IVF insurance coverage. We’ll break down what’s typically covered, why it varies so much, and what you can do if your plan falls short. Plus, we’ll explore fresh angles—like how employers are stepping in, the latest state laws, and real stories from people who’ve navigated this journey. Whether you’re just starting to explore IVF or you’re knee-deep in the process, you’ll find practical tips, new insights, and a clear path forward.

What Is IVF, and Why Does Coverage Matter?

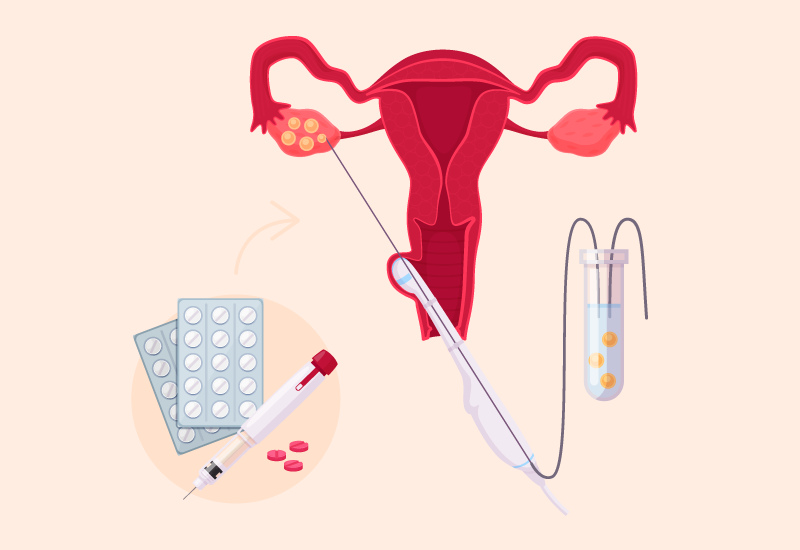

IVF is a medical procedure where eggs are retrieved from the ovaries, fertilized with sperm in a lab, and then transferred into the uterus. It’s a powerful tool for overcoming infertility, but it’s not cheap. A single cycle can cost between $12,000 and $20,000, and many people need multiple rounds to succeed. Add in medications, testing, and follow-up care, and the bill can easily hit $30,000 or more.

Insurance coverage matters because it can make or break access to this treatment. Without it, IVF is out of reach for most families, forcing tough choices—like dipping into savings, taking out loans, or even giving up on the dream of parenthood. Coverage isn’t just about money; it’s about fairness and opportunity. Infertility affects about 1 in 8 couples in the U.S., yet the support they get depends heavily on where they live, who they work for, and what plan they have.

The Big Picture: How Common Is IVF Coverage?

Here’s the reality: IVF coverage isn’t standard across the board. Unlike routine doctor visits or maternity care, fertility treatments are often seen as “optional” by insurance companies. But the tide is turning. More employers and states are recognizing infertility as a medical condition deserving of support.

- Nationwide Stats: A 2024 survey by KFF found that only about 25% of U.S. employers offer IVF coverage in their health plans. For big companies (over 200 employees), that number jumps to over 50%. Still, that leaves millions without help.

- State Laws: As of April 2025, 21 states have some form of infertility insurance mandate, but only 15 explicitly require IVF coverage. These laws vary wildly—some cap the number of cycles, others exclude certain groups like small businesses.

- Employer Trends: Big names like Google, Amazon, and Starbucks now offer IVF benefits to attract talent. In a tight job market, fertility support is becoming a perk that sets companies apart.

So, does your insurance cover IVF? It depends on three main factors: your state, your employer, and your specific plan. Let’s unpack each one.

Factor 1: Where You Live Shapes Your Coverage

Your zip code plays a huge role in whether IVF is covered. State laws, called mandates, dictate what private insurance plans must include. Here’s a snapshot of how it works:

States with Strong IVF Coverage

In places like Illinois, Massachusetts, and New York, laws require most insurance plans to cover IVF. For example:

- Illinois: Mandates up to six egg retrievals if you meet certain conditions, like a year of unsuccessful attempts to conceive.

- New York: Covers three IVF cycles for large group plans (over 100 employees), plus fertility preservation if treatments like chemo might harm your fertility.

States with Partial or No Coverage

In states like Florida or Pennsylvania, there’s no mandate. If your plan covers IVF, it’s because your employer chose to include it—not because they had to. About 29 states fall into this bucket, leaving coverage spotty at best.

A Real Example

Take Sarah, a 32-year-old teacher from Texas. Her state has no IVF mandate, and her school district’s insurance doesn’t cover it. She paid $15,000 out of pocket for one cycle—money she scraped together from savings and a small loan. Compare that to Mia in Massachusetts, whose insurance covered two cycles, leaving her with just $3,000 in out-of-pocket costs. Same treatment, different states, wildly different experiences.

Quick Tip: Check your state’s laws on the Resolve: National Infertility Association website. It’s a goldmine for understanding what’s required where you live.

Factor 2: Your Employer Holds the Key

Even in states without mandates, your job can be a game-changer. Employers decide what benefits to offer, and IVF is increasingly on the table.

Why Employers Care

- Talent Wars: Companies want to keep employees happy. Offering IVF can tip the scales for workers choosing between jobs.

- Low Cost, Big Impact: A 2021 study found 97% of employers who added IVF coverage saw no major spike in health plan costs. It’s a win-win.

Who’s Covered?

- Big Companies: If you work for a Fortune 500 firm, your odds of IVF coverage are higher. Think tech giants or retail chains with deep pockets.

- Self-Insured Plans: Many large employers “self-insure,” meaning they pay claims directly and can customize benefits. The University of Michigan, for instance, added IVF coverage in 2015, boosting usage among its staff threefold.

- Small Businesses: Smaller firms (under 50 employees) often skip IVF coverage due to cost, especially in states without mandates.

Interactive Quiz: Does Your Job Offer IVF Coverage?

Answer these quick questions to get a sense of your odds:

- Do you work for a company with over 200 employees? (Yes/No)

- Is your employer in a competitive industry like tech or finance? (Yes/No)

- Does your state have an IVF mandate? (Yes/No)

If you answered “Yes” to two or more, your chances are decent. Call HR to confirm!

Factor 3: Your Plan’s Fine Print

Even if your state or employer offers IVF coverage, the details matter. Plans differ in what they cover, how much, and who qualifies.

What’s Typically Covered?

- Diagnostics: Tests like hormone checks or semen analysis are often covered, even if treatment isn’t.

- Medications: Fertility drugs (costing $3,000-$5,000 per cycle) might be partially covered.

- IVF Cycles: Some plans cap coverage at 1-3 cycles or a dollar amount (e.g., $15,000 lifetime max).

Common Catch-22s

- Pre-Approval: You might need to prove infertility (e.g., 12 months of trying) before coverage kicks in.

- In-Network Only: Going to an out-of-network clinic could double your costs.

- Exclusions: Same-sex couples or single parents sometimes face barriers, even in mandate states.

Pro Tip: Grab your insurance policy (look for the “Summary of Benefits”) and search for “infertility” or “IVF.” If it’s vague, call your insurer. Ask: “What’s covered, what’s not, and what do I need to qualify?”

The Hidden Gaps: What Most Articles Miss

While plenty of blogs cover the basics, they often skip over lesser-known hurdles and opportunities. Here are three points you won’t find in the top Google results—and why they matter.

1. The Self-Insured Loophole

About 60% of U.S. workers are on self-insured plans, where employers call the shots. Federal law (ERISA) exempts these plans from state mandates. So, even in a “covered” state like New Jersey, your IVF might not be covered if your company self-insures and opts out.

Case Study: Jake, a 35-year-old engineer in Connecticut, assumed his state’s mandate meant IVF was covered. But his self-insured employer excluded it, leaving him with a $20,000 bill. Lesson? Ask HR if your plan is self-insured.

2. Fertility Preservation Is Gaining Traction

If you’re facing cancer treatment or other procedures that could harm fertility, coverage for egg or sperm freezing is on the rise. States like New York and California now mandate it, and some employers (e.g., Apple) offer it as a perk. A 2023 study in the Journal of Clinical Oncology found 70% of young cancer patients wanted fertility preservation, but only 20% could afford it without insurance.

Action Step: If this applies to you, ask your doctor to write a letter proving medical necessity. It could sway your insurer.

3. The Emotional Cost of Coverage Gaps

Money isn’t the only burden. A 2024 survey by the American Society for Reproductive Medicine (ASRM) found that 40% of IVF patients without coverage reported higher stress and depression levels. The constant haggling with insurers or scraping funds takes a toll.

Real Talk: Lisa, a 29-year-old from Ohio, said, “I spent more time fighting my insurance than preparing for IVF. It felt like they didn’t care.” Her story isn’t unique—but it’s rarely discussed.

How to Check Your Coverage: A Step-by-Step Guide

Don’t guess—know. Here’s how to figure out if IVF is covered for you:

- Find Your Policy: Log into your insurance portal or call member services for your plan documents.

- Search Key Terms: Look for “infertility,” “assisted reproduction,” or “IVF.” Highlight any limits or requirements.

- Call Your Insurer: Say, “I’m exploring IVF. Can you tell me what’s covered under my plan and what steps I need to take?”

- Talk to HR: If it’s an employer plan, ask: “Do we offer IVF benefits? Is our plan self-insured?”

- Document Everything: Write down names, dates, and answers. It’s your ammo if you need to appeal a denial.

Bonus: Record calls (with permission) for clarity. It saved one couple $5,000 when their insurer backtracked on a promise.

What If Insurance Doesn’t Cover IVF?

No coverage? You’ve still got options. Here’s how to make IVF work without breaking the bank:

Option 1: Shop Around for Plans

- Open Enrollment: Switch to a plan with IVF benefits during your next enrollment window (usually November-December).

- Spouse’s Plan: If your partner’s job offers better coverage, jump on it.

- Marketplace Plans: Some Affordable Care Act plans in mandate states include IVF—check Healthcare.gov.

Option 2: Negotiate with Your Employer

More companies are open to adding IVF benefits. Pitch it like this:

- “It’s a low-cost way to boost retention. Studies show it doesn’t spike premiums much.”

- Team up with coworkers to make a group request—strength in numbers!

Option 3: Explore Financing

- Clinics: Many offer payment plans or discounts for multiple cycles.

- Loans: Companies like Future Family provide IVF-specific loans with lower interest rates.

- Grants: Groups like Baby Quest Foundation award funds to cover treatment costs.

Option 4: Move to a Mandate State (Yes, Really!)

Extreme? Maybe. But some families relocate for coverage. A 2022 ASRM report found a 10% uptick in “fertility migration” to states like Illinois and Maryland.

Checklist: Your No-Coverage Survival Kit

✔️ Compare clinic prices—costs vary by $5,000+ between providers.

✔️ Ask about “shared risk” programs (pay upfront, get a refund if it fails).

❌ Don’t drain your emergency fund—keep a safety net.

✔️ Look into clinical trials for free or discounted IVF (search ClinicalTrials.gov).

The Future of IVF Coverage: What’s Coming?

Coverage isn’t static—it’s shifting fast. Here’s what’s on the horizon as of April 2025:

Political Promises

IVF hit the 2024 election spotlight. Former President Trump pledged federal funding or mandates for IVF coverage, though details are fuzzy. Democrats pushed the “Right to IVF Act,” which would require private insurers to cover it. Neither has passed yet, but the buzz is growing.

Employer Momentum

A 2024 Mercer survey showed 36% of large employers now offer IVF benefits, up from 27% in 2020. As workers demand more, expect this to climb.

State-Level Wins

New players like British Columbia (Canada) launched a public IVF program in 2025, funding one cycle up to $19,000. Could U.S. states follow? Advocates say yes—watch states like Colorado and Oregon for pilot programs.

Poll: What Do You Think?

Should IVF be covered like other medical treatments?

A) Yes, it’s a health issue.

B) No, it’s elective.

C) Only for certain cases (e.g., medical necessity).

Drop your vote in the comments—we’re curious!

Busting Myths: What People Get Wrong About IVF Coverage

Misinformation can derail your plans. Let’s clear up some common mix-ups:

- Myth: “IVF is always fully covered in mandate states.”

Truth: Mandates often exclude self-insured plans or limit cycles. Check the fine print. - Myth: “If diagnostics are covered, IVF is too.”

Truth: Many plans stop at testing—treatment’s a separate battle. - Myth: “It’s too expensive for employers to offer.”

Truth: Data shows it’s a drop in the bucket compared to other benefits.

A Deeper Dive: The Numbers Behind IVF Costs

Let’s crunch some original numbers to see what you’re really up against. Based on 2024 clinic data and insurance trends, here’s a breakdown:

| Expense | Average Cost (No Insurance) | With Partial Coverage | Notes |

|---|---|---|---|

| IVF Cycle (1 round) | $12,000 – $20,000 | $2,000 – $5,000 | Assumes 20% coinsurance |

| Medications | $3,000 – $5,000 | $500 – $1,500 | Varies by dosage |

| Genetic Testing | $1,000 – $3,000 | $0 – $500 | Often optional |

| Storage (1 year) | $500 – $1,000 | $0 – $200 | Freezing eggs/embryos |

| Total (1 Cycle) | $16,500 – $29,000 | $2,500 – $7,200 | Huge savings with coverage! |

Mini Analysis: If 25% of employers cover IVF (per KFF), and the U.S. has 157 million workers, about 39 million have access. But with only 15 states mandating it, gaps persist for the other 118 million. Closing that gap could save families $10,000+ per cycle.

Voices from the Frontline: Real IVF Stories

Numbers tell part of the story—people tell the rest. Here’s what folks are saying:

- Tina, 34, California: “My insurance covered meds but not the procedure. We crowdfunded $10,000 from friends. It worked—our son’s 2 now.”

- Mark, 40, Alabama: “No mandate here, and my job didn’t cover it. We moved to a cheaper clinic two states over. Saved $4,000, but the travel was brutal.”

- Priya, 28, Illinois: “Three cycles covered, and I only paid $2,000 total. I wish everyone had this—it’s not fair otherwise.”

These stories show the patchwork of experiences—and the grit it takes to push through.

Your Next Steps: Making IVF Happen

Wherever you stand, you’ve got power to act. Here’s your roadmap:

- Assess Your Coverage: Use the step-by-step guide above. Knowledge is your first weapon.

- Talk to Your Doctor: They can code treatments to maximize insurance payouts or point you to affordable clinics.

- Explore Alternatives: From financing to relocation, weigh every option against your budget and goals.

- Advocate: Join groups like Resolve to push for better laws and employer benefits.

Final Thought: IVF is a marathon, not a sprint. Coverage or not, you’re not alone—resources and communities are out there to help.